Rewards

CKB block rewards comprise base reward, secondary reward, proposal reward, and commitment reward, jointly determined by Nervos’ tokenomics and the NC Max consensus.

- Base Reward: Halves every 4 years, totaling 33.6 billion CKB.

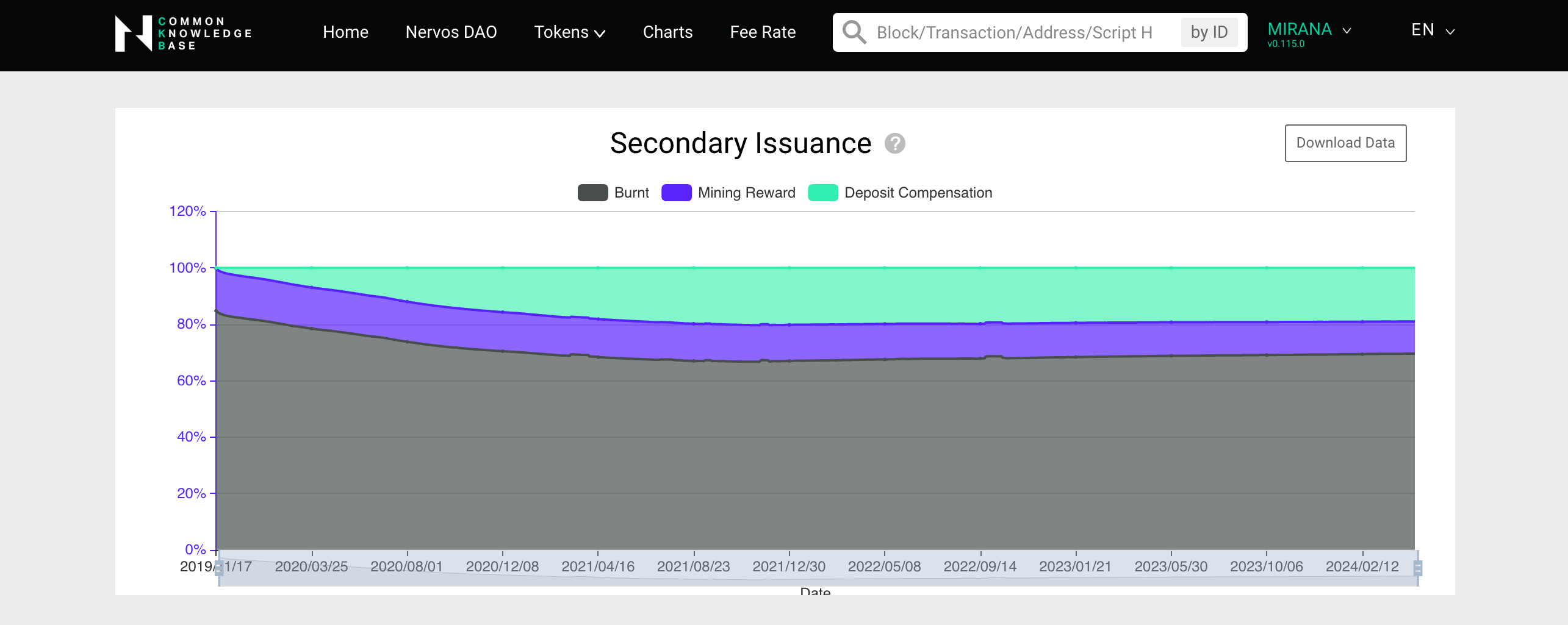

- Secondary Reward: Fixed at 1.344 billion annually, distributed based on network usage.

- Proposal and Commit Rewards: Sourced from transaction fees

Base reward

CKB's base reward, similar to Bitcoin's issuance, has a fixed upper limit and undergoes halving approximately every four years. Unlike Bitcoin, which employs fixed block rewards and difficulty adjustment of every 2016 blocks, CKB uses the NC-Max consensus, adjusting difficulty based on the Orphan Rate. The Orphan Rate of the previous Cycles is calculated, and then the difficulty adjustment is calculated based on a series of parameter adjustments to maintain a relatively constant orphan block rate for the entire network. During each difficulty adjustment, the block count for the next Cycle is calculated. Therefore, the number of blocks mined within each Cycle vary.

CKB's adjustments are made based on Cycles. The total block reward within each Cycle is a fixed value, with a target Cycle time of 4 hours. That is to say, when the block interval of a Cycle becomes longer and the number of blocks decreases, the block reward per block will increase accordingly, and vice versa. Through this method, CKB ensures that a fixed total block reward is always distributed over an integer number of Cycles every 4 hours, ensuring that the system's halving schedule is maintained.

The total amount of base reward is 33.6 billion CKB, halving every 4 years. The first halving took place on November 19, 2023.

Secondary reward

Unlike Bitcoin, which relies solely on basic issuance, CKB introduces secondary issuance to maintain miner incentives and network security after the halving.

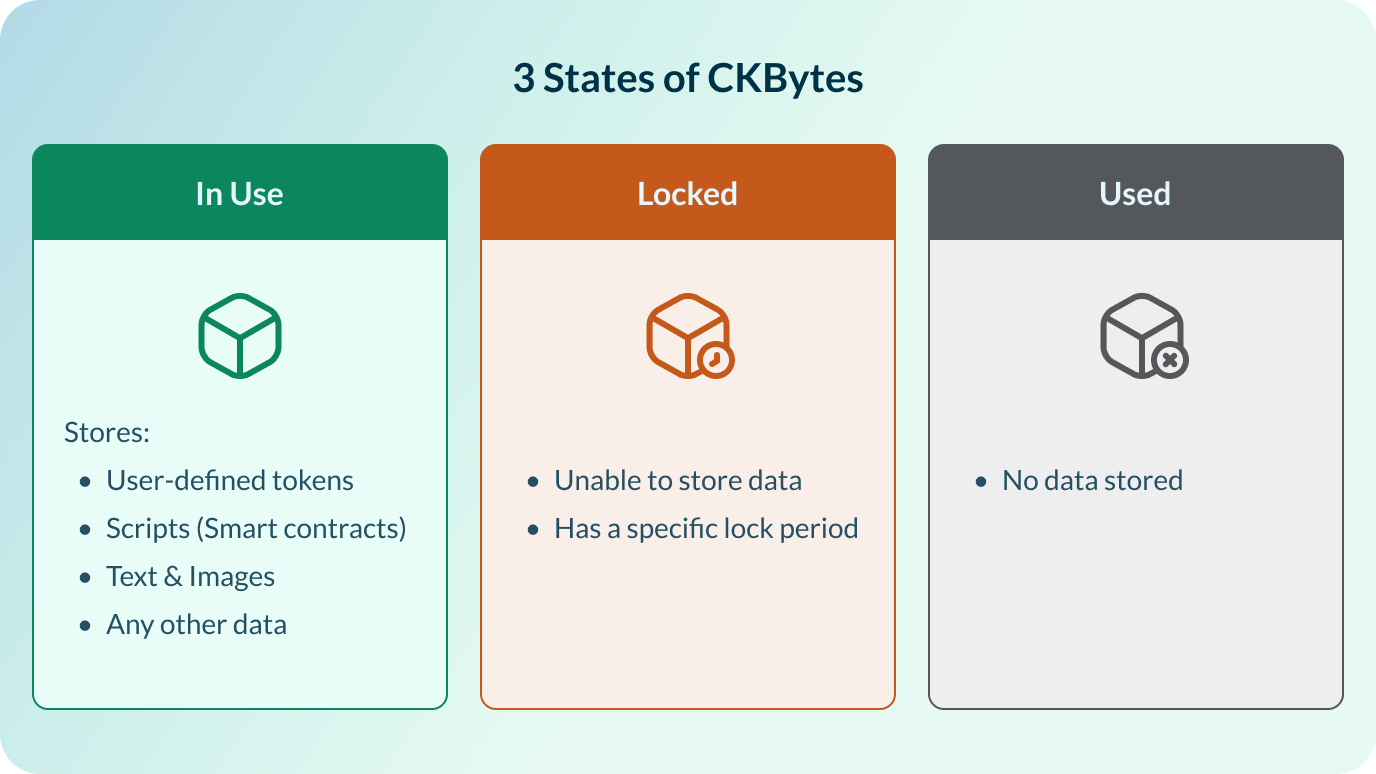

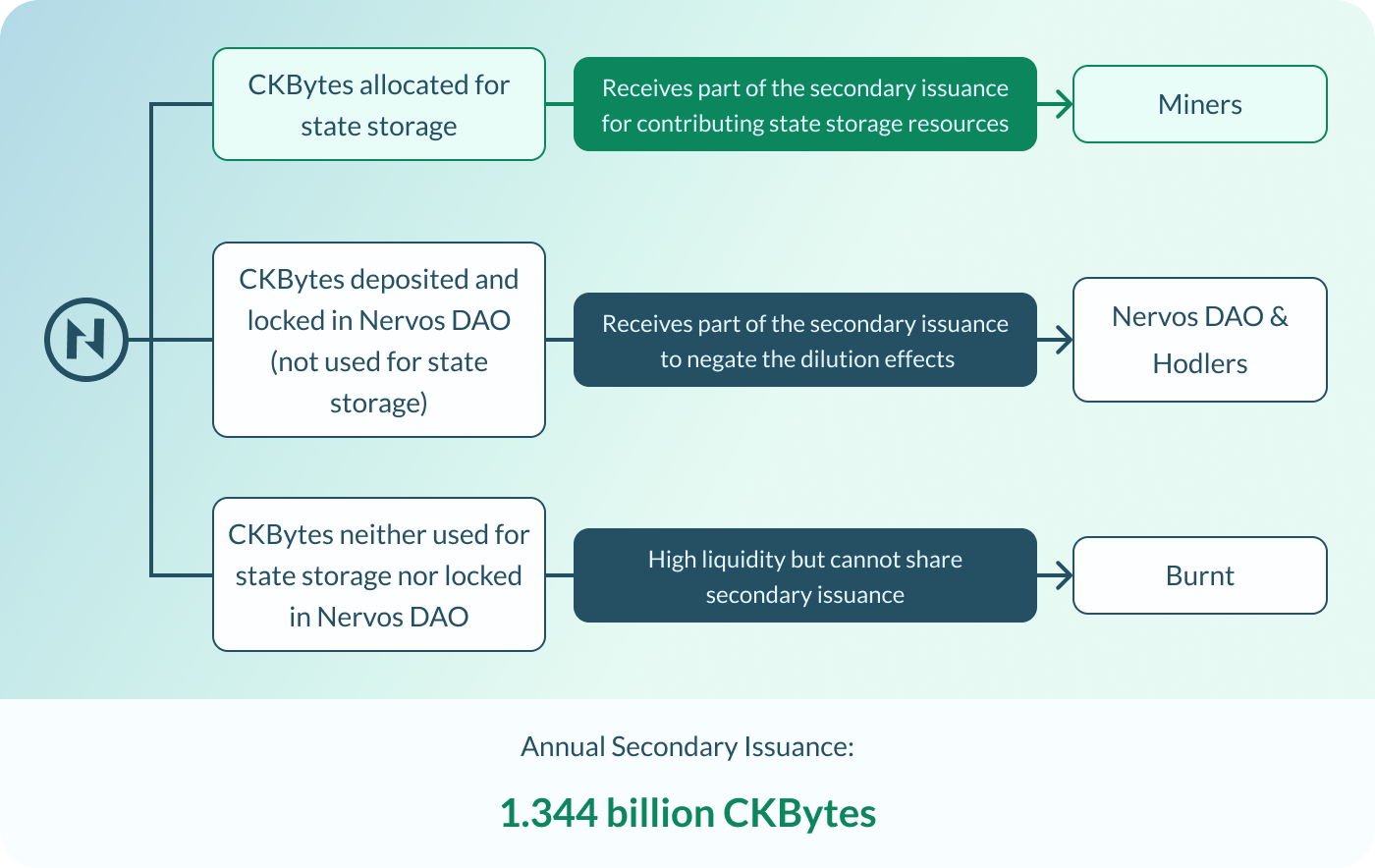

Secondary issuance occurs annually alongside basic issuance, providing a fixed amount of CKB identical to basic issuance. However, not all secondary issuance goes to miners. It's distributed based on the network's state. Miners receive compensation for storing and actively using CKB, but not for CKB without data storage or locked in Nervos DAO.

Three States of CKBytes

The total amount of secondary issuance issued annually is fixed at 1.344 billion. The portion allocated to miners depends on the CKBytes' usage rate. Higher usage rates lead to more CKBytes for miners.

Secondary Issuance Allocation

Proposal Reward and Commit Reward

Proposal Reward and Commit Reward are both sourced from transaction fees. When a transaction enters the transaction pool, it subsequently enters the Proposal Zone, followed by the Commitment Zone (meaning the transaction is packaged into a block). This a two-step confirmation process comes from NC-Max, to eliminate the bottleneck of block propagation delay.

Miners who mine block N will receive:

- Proposal Reward: 40% of the transaction fees of the transactions proposed in block N and committed from block N+2 to N+10.

- Commit Reward: 60% of the transaction fees of the transactions proposed but not committed from block N-10 to block N-2, and eventually committed in block N.

- All rewards are allocated at block N+11.

The amount of CKBytes mined annually can be calculated by the formula below:

Annual Quantity of CKBytes Mined = Base Reward + Secondary Reward - CKBytes Burned in Secondary Issuance

Where:

- Base Reward: 33.6 billion CKBytes in total, halved every 4 years.

- Secondary Reward: 1.344 billion per year

- CKBytes Burned in Secondary Issuance: This refers to the CKB allocated to the treasury, which is dynamically changing. The quantity is proportional to the percentage of circulating CKB to the total amount. According to CKB Explorer, at the time of writing, the CKBytes burnt accounted for 69.58% of the secondary issuance.